M&A Insights

Stay on Top of the Changing M&A Landscape.

M&A Deal Points | Understanding What Matters Most to Sellers

The lower middle market operates under a unique set of dynamics compared to the middle and public markets. While large transactions often prioritize price, terms, closing certainty, and fit—in that order—the priorities in lower middle market transactions are distinctly different.

M&A Market: Look Before You Leap – A Guide to Earnouts

Before agreeing to an earnout as a seller, it’s important to understand the broader context of how they work and their potential pitfalls. Here are some key insights:

What Comes Out of the Purchase Price in an M&A Transaction?

The Role of Default Positions in M&A

Default positions in M&A terms, which occur automatically unless changed, significantly impact deals. They also determine where earnout funds are held and whether post-closing roles renew automatically. These defaults influence transactions both legally and through relationship dynamics.

When Suitors Come Knocking {with a diligence phalanx in tow}

The dynamic of running an M&A sale process differs significantly from responding to unsolicited offers. Using an Indication of Interest (IOI) can streamline initial evaluations, preserving sensitive information and saving time. If interest persists, running a competitive process can maximize value. Ultimately, understanding who is courting whom is crucial for navigating these transactions effectively.

How to Choose the Right Bidder in a Sell-Side M&A: Evaluating LOIs

It all begins with an idea.

Navigating 'Simple' Deals: Avoiding Pitfalls in Buy-Side Transactions

Exclusivity Agreements: When and How to Use Them

Kicking off another post, this time focusing on exclusivity or no-shop provisions.

How are Lower Middle Market Companies Valued?

What is Adjusted EBITDA and an Add-back?

What is Working Capital and How Does it Work in M&A Transactions?

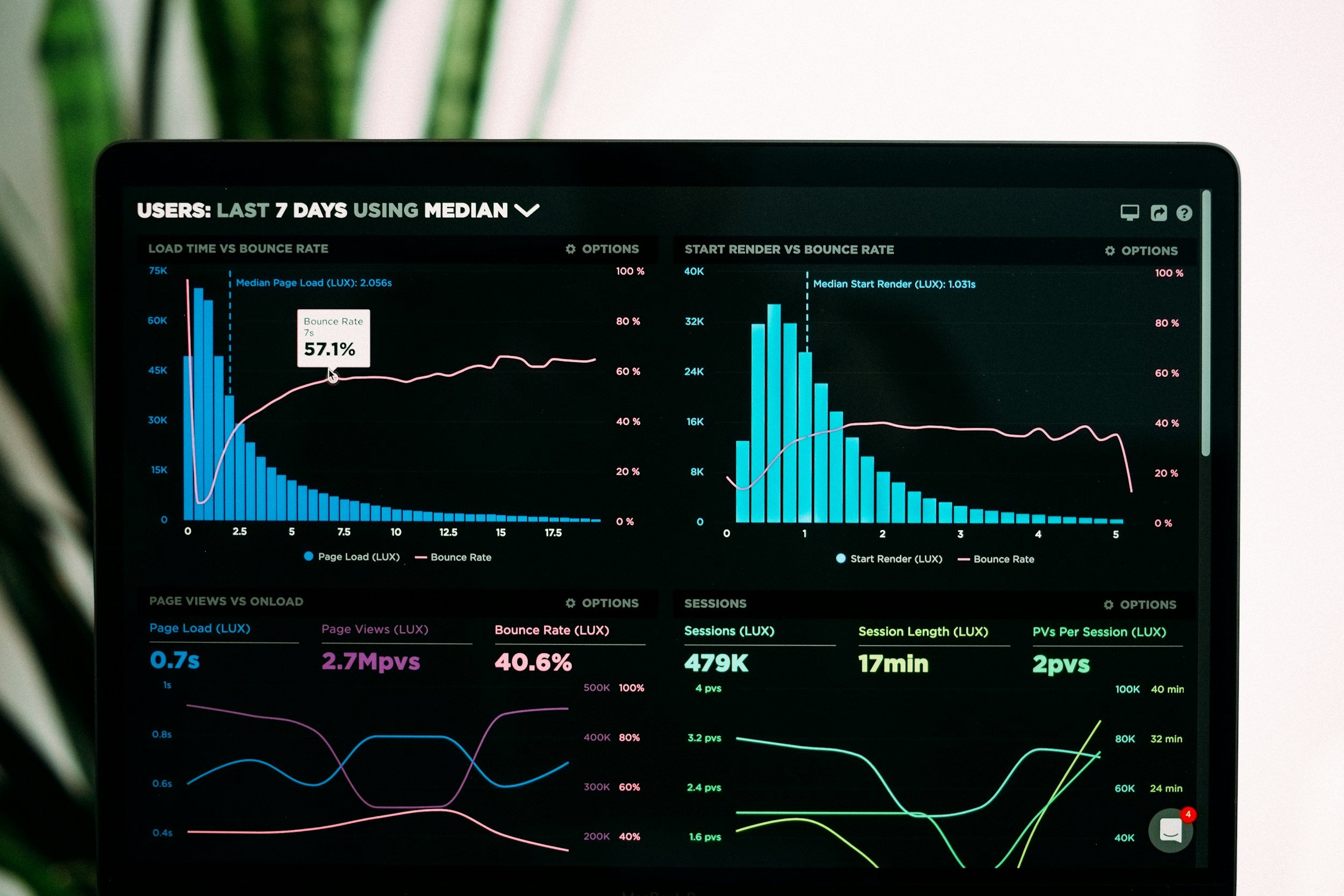

{M&A Process/5} Market Intelligence

Once engaged, Sierra Pacific Partners conducts a market study using proprietary databases to assess the company’s value, determine active buyers in the industry, and talk to those buyers to uncover how they view and weigh various value drivers

Understanding Indemnification Terms in M&A Transactions: Key Considerations for Buyers and Sellers

{M&A Process/4} Sell-side Preparation

Both prior to and following engagement, we’ll need information from the seller to assist with valuation, marketing, and diligence.

Maximizing Synergies in M&A: How Strategic Buyers Drive Higher Valuations

Most M&A participants know that strategics - whether a corporate buyer or a PE portfolio company (a hybrid strategic) - tend to value targets the most because of synergies. So, what goes into synergies and, more importantly, using them to drive purchase price?

{M&A Process/3} Different types of M&A sale processes

There are a number of ways to transfer a company depending on client goals and circumstances y or combination.

Deal Diary: How to Handle Minority and Marketability Discounts in Operating Agreements

Recently, while drafting an operating agreement for a surgery center, we used a formula-based redemption price with an appraisal option if contested. Should appraisers apply minority and marketability discounts?

M&A Deal Points | A Deep Dive on SaaS Valuation

We now turn to a final factor that quantifies elements from across the other factors: SaaS metrics.

Deciphering Deal Structures: Insights into M&A Consideration Mix

In M&A, the consideration mix or deal structure can be just as crucial, if not more so, than the headline purchase price for sellers. Earnouts, rollover equity, and seller notes don't always translate into expected cash returns.

Maximizing Business Value: Insights from M&A Advisors

In M&A, sellers often hold optimistic views on their business's value. Our role as advisors is to provide data-driven valuation advice. During a discussion on diligence with a client, we emphasized the need for focus and momentum in the sale process.