M&A Insights

Stay on Top of the Changing M&A Landscape.

Essential Questions for Buyers and Sellers in Initial M&A Discussions

What questions should you or your advisor anticipate from buyers during an initial call or meeting? And, if you're a buyer, what questions should you ask?

{M&A Process/8} Buyer list

Why Asset Deals Dominate Smaller M&A Transactions

When Suitors Come Knocking {with a diligence phalanx in tow}

The dynamic of running an M&A sale process differs significantly from responding to unsolicited offers. Using an Indication of Interest (IOI) can streamline initial evaluations, preserving sensitive information and saving time. If interest persists, running a competitive process can maximize value. Ultimately, understanding who is courting whom is crucial for navigating these transactions effectively.

Navigating 'Simple' Deals: Avoiding Pitfalls in Buy-Side Transactions

Exclusivity Agreements: When and How to Use Them

Kicking off another post, this time focusing on exclusivity or no-shop provisions.

{M&A Process/5} Market Intelligence

Once engaged, Sierra Pacific Partners conducts a market study using proprietary databases to assess the company’s value, determine active buyers in the industry, and talk to those buyers to uncover how they view and weigh various value drivers

Understanding Indemnification Terms in M&A Transactions: Key Considerations for Buyers and Sellers

{M&A Process/2} How we add value

Before embarking on an M&A process, many sellers think an investment banker or M&A advisor’s primary role is to find a buyer. In fact, post-closing surveys of sellers repeatedly show the opposite--that sellers view buyer sourcing as the least important part of what advisors do.

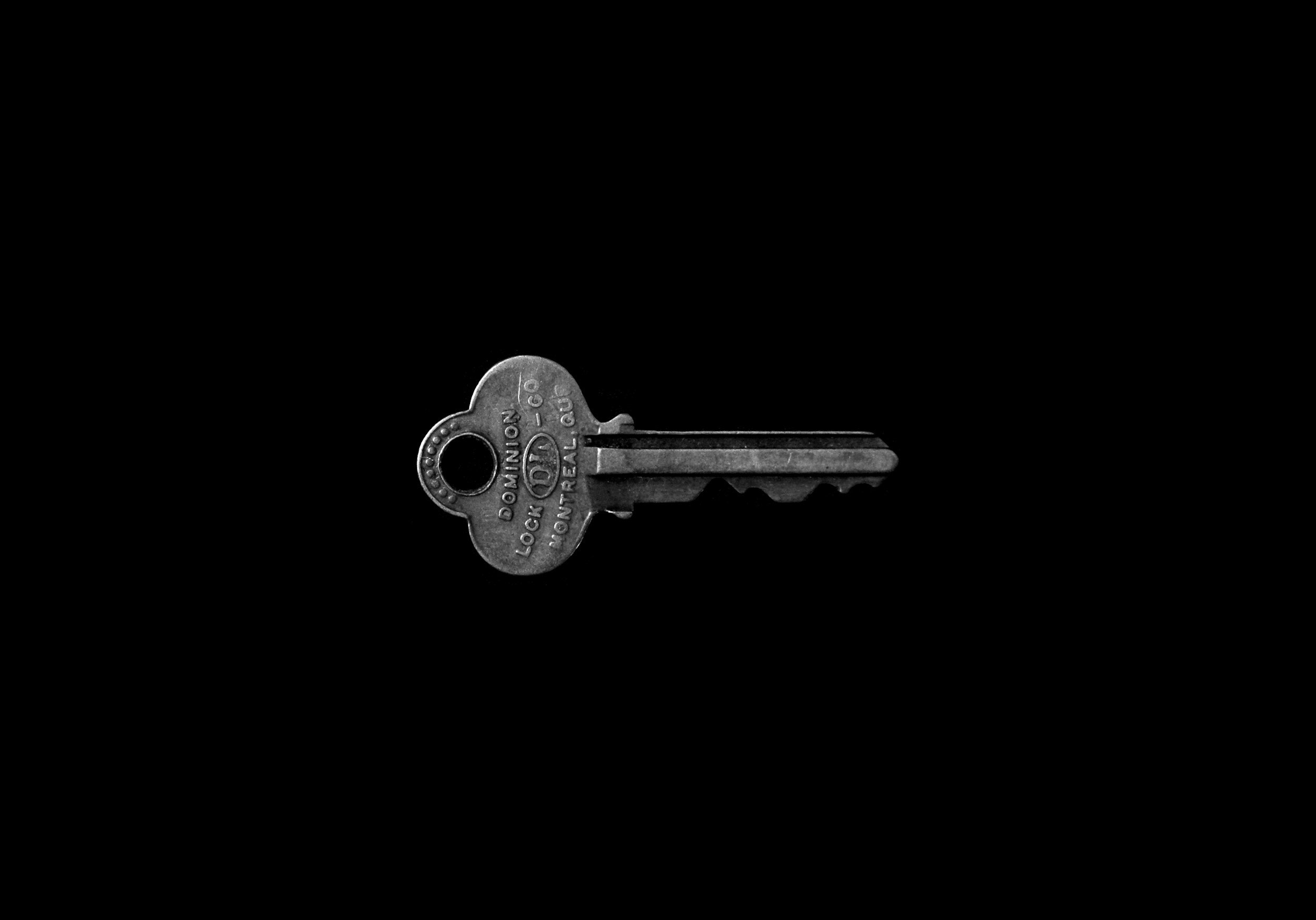

Unlocking M&A Value: Harnessing Synergies to Drive Purchase Price

Strategic buyers in M&A transactions often value targets higher due to potential synergies. Unlike non-strategics who base valuations on EBITDA, strategics consider added value from synergies, such as cost savings, revenue enhancement, gross margin improvement, and strategic benefits.