M&A Insights

Stay on Top of the Changing M&A Landscape.

From Valuation to Closing: How M&A Advisors Manage Confidential Sales

When Suitors Come Knocking {with a diligence phalanx in tow}

The dynamic of running an M&A sale process differs significantly from responding to unsolicited offers. Using an Indication of Interest (IOI) can streamline initial evaluations, preserving sensitive information and saving time. If interest persists, running a competitive process can maximize value. Ultimately, understanding who is courting whom is crucial for navigating these transactions effectively.

Understanding Indemnification Terms in M&A Transactions: Key Considerations for Buyers and Sellers

Ready to Sell Your Business? Here’s How to Take the First Step

What does it take to capture a buyer's attention and prompt them to submit a Letter of Intent (LOI)? According to the latest Alliance of M&A Advisors survey, several key factors influence buyers' decisions, including growth potential, stable revenue, quality of the management team, EBITDA margin, and synergies.

Essential Questions for Buyers and Sellers in Initial M&A Discussions

What questions should you or your advisor anticipate from buyers during an initial call or meeting? And, if you're a buyer, what questions should you ask?

Maximizing Synergies in M&A: How Strategic Buyers Drive Higher Valuations

Most M&A participants know that strategics - whether a corporate buyer or a PE portfolio company (a hybrid strategic) - tend to value targets the most because of synergies. So, what goes into synergies and, more importantly, using them to drive purchase price?

Exclusivity Agreements: When and How to Use Them

Kicking off another post, this time focusing on exclusivity or no-shop provisions.

Navigating 'Simple' Deals: Avoiding Pitfalls in Buy-Side Transactions

Deal Diary: How to Handle Minority and Marketability Discounts in Operating Agreements

Recently, while drafting an operating agreement for a surgery center, we used a formula-based redemption price with an appraisal option if contested. Should appraisers apply minority and marketability discounts?

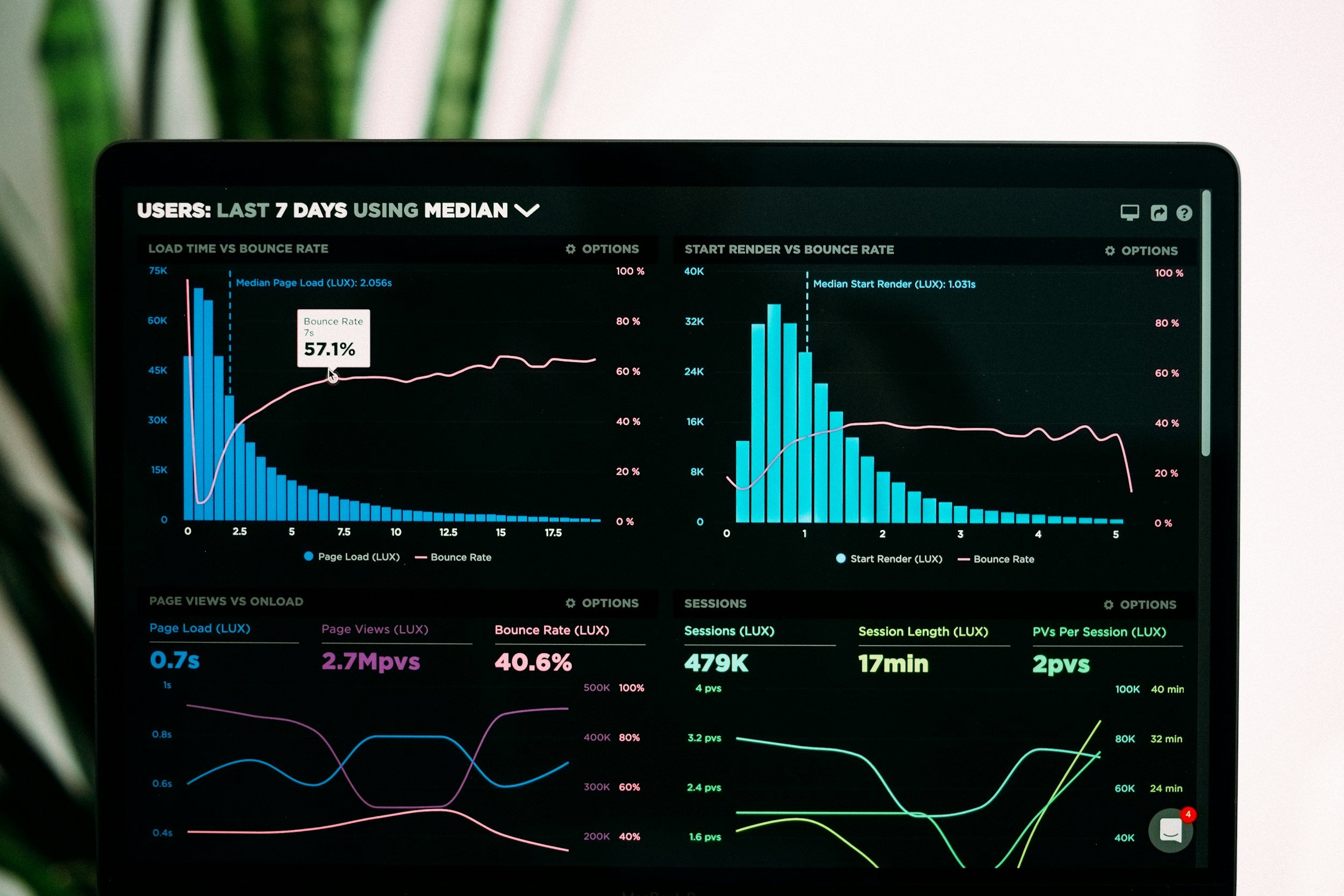

M&A Deal Points | A Deep Dive on SaaS Valuation

We now turn to a final factor that quantifies elements from across the other factors: SaaS metrics.

Deciphering Deal Structures: Insights into M&A Consideration Mix

In M&A, the consideration mix or deal structure can be just as crucial, if not more so, than the headline purchase price for sellers. Earnouts, rollover equity, and seller notes don't always translate into expected cash returns.

Maximizing Business Value: Insights from M&A Advisors

In M&A, sellers often hold optimistic views on their business's value. Our role as advisors is to provide data-driven valuation advice. During a discussion on diligence with a client, we emphasized the need for focus and momentum in the sale process.

SaaS Valuation Demystified: Tips for Buyers and Sellers in the Market

Traditional SBA valuation metrics often fall short when applied to SaaS businesses due to their unique characteristics, such as huge total addressable markets and opportunities for explosive growth. This has created a market where business transfers command higher prices, attracting various buyers with ample funding sources.

{M&A Process/2} How we add value

Before embarking on an M&A process, many sellers think an investment banker or M&A advisor’s primary role is to find a buyer. In fact, post-closing surveys of sellers repeatedly show the opposite--that sellers view buyer sourcing as the least important part of what advisors do.

Success Comes at a Price - Cost of Capital

Founders considering an exit often approach Sierra Pacific Partners, having achieved success and raised capital for their ventures. Ultimately, a seller's capital structure and investor goals profoundly influence strategic alternatives in M&A transactions.

{M&A Process/1} Understanding our clients’ goals

In this 12-part mini series on the sell-side M&A process, we'll go over the general process you can expect working with with an M&A advisor, from pre-engagement to post-closing. Let's get started

Unlocking M&A Value: Harnessing Synergies to Drive Purchase Price

Strategic buyers in M&A transactions often value targets higher due to potential synergies. Unlike non-strategics who base valuations on EBITDA, strategics consider added value from synergies, such as cost savings, revenue enhancement, gross margin improvement, and strategic benefits.